October 8, 2021

The Ideal QA Process in Digital Advertising

Holiday 2020: Facebook CPM Trends Show Opportunity to Turn Up Spend

For B2C advertisers reliant on Facebook and other social channels to drive holiday sales, CPMs are always the name of the game in Q4, and like many things in 2020, this year is different than years past. Where is there opportunity? How much should we budget and where to fill our funnel? How can we stay competitive in what’s sure to be the thunderdome of ecommerce?

For day-by-day guidance on holiday advertising on Facebook, Google, Amazon, and more, check out our Customizable 2020 Holiday Planning Calendar for retailers.

While the industry’s been preparing for CPMs are going to skyrocket due to elections, big box retailers shifting toward online sales in lieu of in-person Black Friday, and other factors, Metric Theory clients had seen weekly CPMs upwards 30% lower this year compared to 2019, and costs much closer to what they experienced as far back as 2018. It’s only in the last two weeks leading up to the election that we’ve seen CPMs meet their 2019 levels.

Facebook CPM for Metric Theory ecommerce clients has trended consistently under 2019 levels for most of this year since the onset of COVID-19.

Why have CPMs been lower than expected this year?

As with pretty much everything this year, the pandemic has a role to play. Fifty-four percent of respondents to Facebook’s survey said they’re spending more time than usual on the internet. This leads to more impressions, and with higher conversion rates from increased online shopping (which 39% of us are doing more than usual as well), it’s led to a favorable market for retailers who can invest in Facebook ads.

Where CPM opportunity remains for retailers as we hit holiday crunch time

Looking at a sampling of our retail clients, and breaking those trends down by the highest-yield placements like Instagram Stories, Facebook and IG Feeds, Facebook Marketplace and IG Explore, Facebook Newsfeed is where we’re seeing the biggest opportunity by combination of CPM savings and scalability. Through October, this sample saw 26% lower cost for Facebook feed ads compared to 2019.

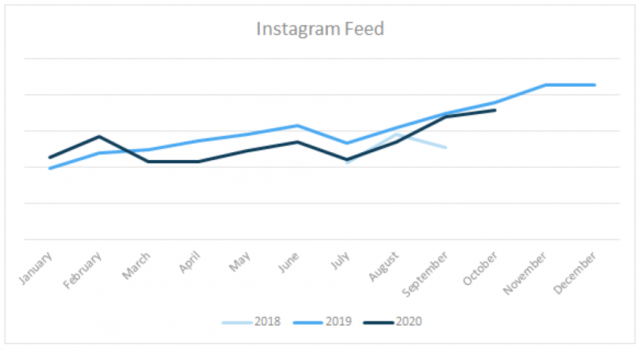

Compare that to the Instagram feed for the same group, where, though still trending below 2019 levels, costs were running just 5% lower than the same time last year.

Takeaways for retailers in November

While we have seen some tightening in the CPM gap for Facebook ads between 2019 and 2020 recently, and the same can be said for other peak sales points over the year, even flat CPMs represent an opportunity for retailers who want to reach for more new customer acquisition this holiday season. And, despite current trends, the combination of pandemic factors has taught us that monitoring CPM levels and acting quickly to move on opportunities can lead to smashing results.

Retargeting is where we usually see the most drastic increases in CPMs during Q4, mainly due to limited audience sizes. By increasing the scale of your prospecting campaigns and getting as many users to your site as possible prior to the peak buying, you’re maximizing the return you can expect over those times. saturate your primed retargeting audience for purchasers during the highest conversion rates.

To meet and beat your goals this holiday, seek out more budget to fill the top of your funnel through visual, high-volume placements like Feeds and Stories, especially on Facebook. Many advertisers may choose for a time post-election to turn down Facebook advertising for brand reasons, but since we can’t be sure exactly when the holiday surge will hit this year (download our 2020 Holiday Ecommerce Planning Calendar for ongoing updates), the next couple of weeks are incredibly important for building brand awareness before peak shopping windows.